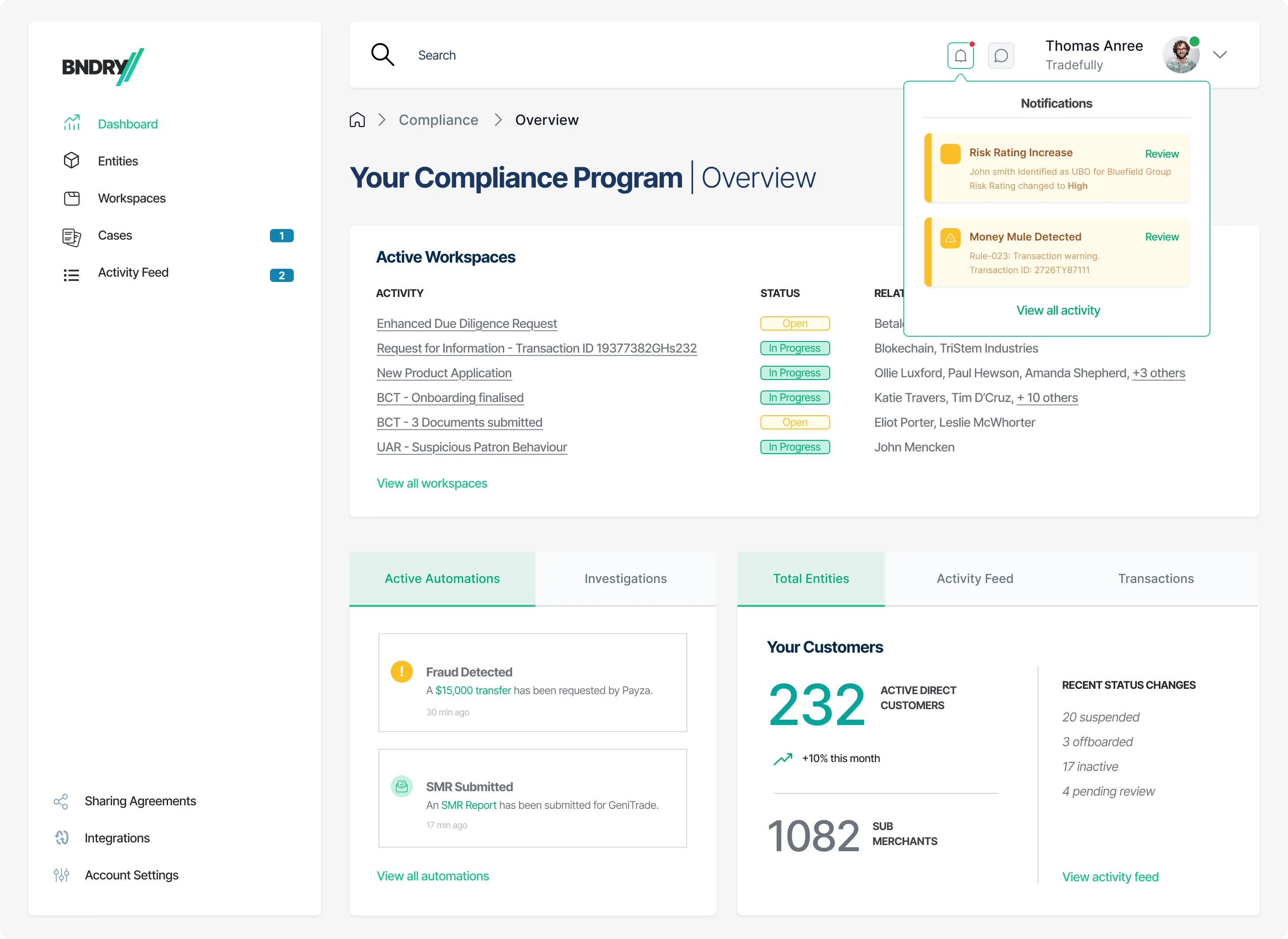

One place to manage your customer risk data and processes for the entire compliance lifecycle.

Plug in your current tools and data sources, automate workflows, trigger enhanced due diligence during onboarding, share compliance data to your data lake...

Build it with BNDRY.

80%

Faster to generate and submit suspicious matter reports.

100bn+

Global records to verify the identity of customers.

6x

Faster to identify and investigate unusual activity.

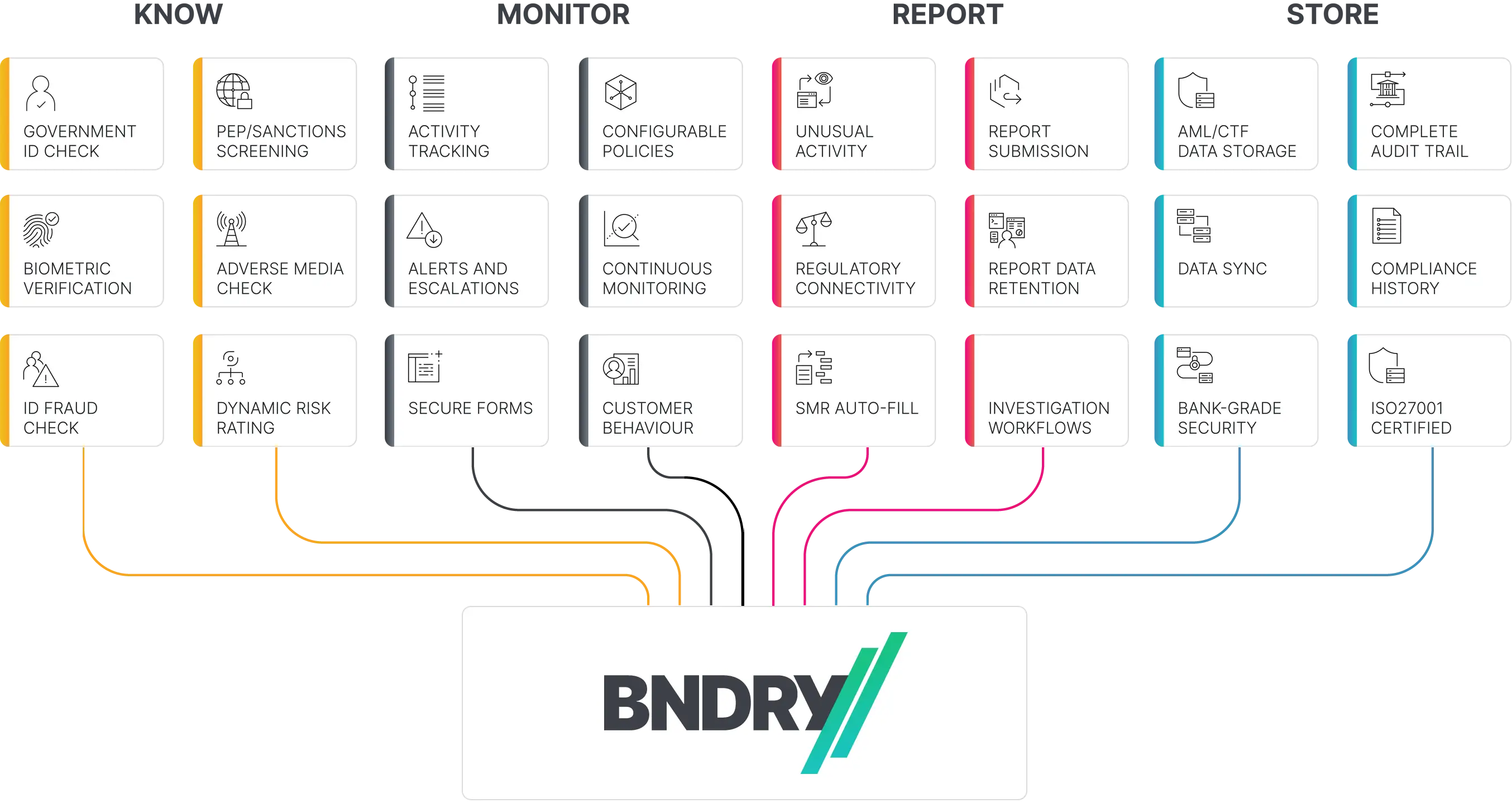

Tailored customer onboarding journeys

Onboard businesses and individuals with custom questionnaires and embedded ID Verification and AML checks for PEPs and Sanctions.

Start With Know

Flag unusual activity for investigation

Rules-based automation to receive alerts whenever unusual transaction patterns are identified. Monitor for changes to customer profiles and receive automatic risk scores.

Start With Monitor

Submit SMRs, automate cross-border and threshold transaction reports

Conduct your investigations and data capture for regulatory reporting in one platform. Report directly to regulators without ever leaving BNDRY.

Start With Reports

A secure data vault to retain customer data

A bank-grade data vault for every non-bank out there. Meet AML/CTF data retention obligations and ensure sensitive customer PII is protected.

Start With StoreWhether you’re designing new products, running a compliance program, or leading your compliance team’s tech stack, BNDRY allows you to move fast and stay compliant.

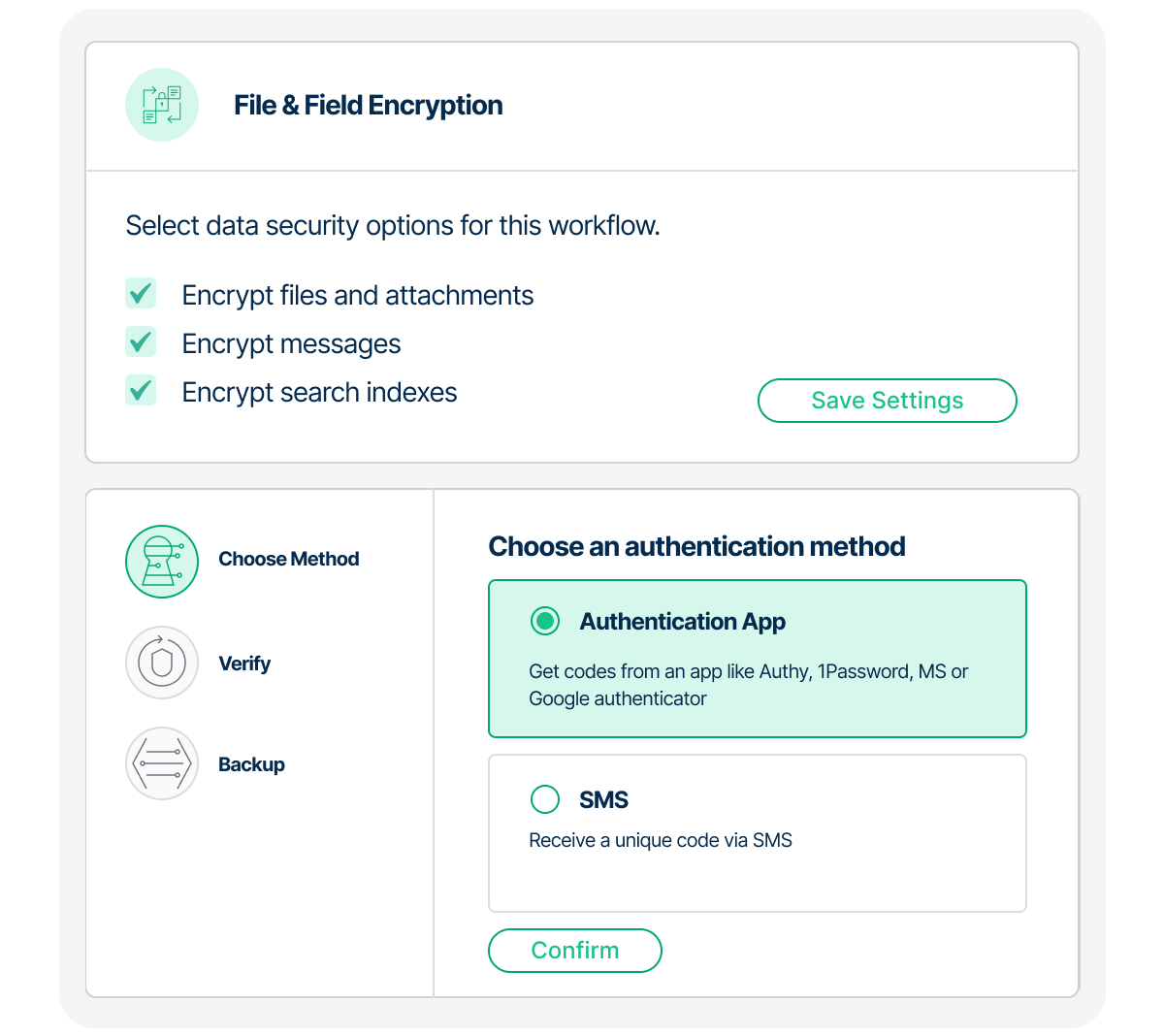

Your data stays safe, always. BNDRY is built with industry-standard encryption, strict access controls and a zero-compromise approach to privacy.

Plug in your data. Orchestrate your workflows.

Automate the boring stuff.